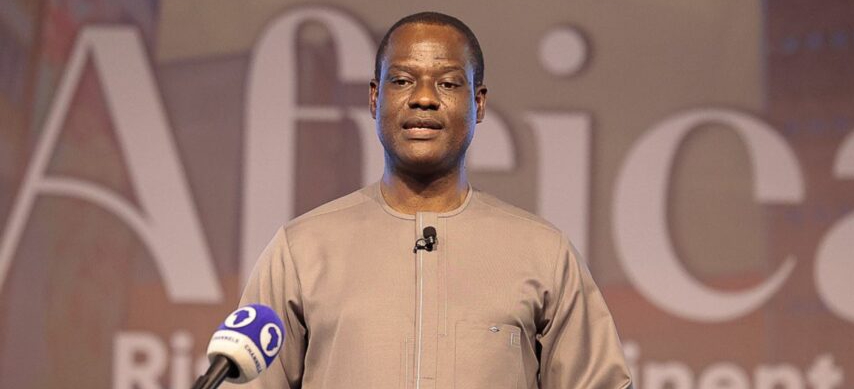

Chairman of the Tax Reforms Committee, Taiwo Oyedele

Presidential committee plans tax revolution, exempting 95% of informal sector

The Presidential Fiscal Policy and Tax Reforms Committee (PFPTRC), established earlier this year by President Bola Tinubu, has unveiled plans to overhaul Nigeria’s tax system, with a significant focus on exempting 95% of the informal sector from all taxes.

Chairman of the Committee, Taiwo Oyedele, revealed this development to journalists at the close-out retreat of the PFPTRC in Abuja over the weekend.

He emphasized that the primary objective of this initiative is to alleviate the burden of multiple taxation on small businesses and low-income individuals.

Oyedele reiterated the importance of supporting citizens in the informal sector, who are working hard to earn a legitimate living, by refraining from over-burdening them with taxes.

”Our committee aims to nurture their economic growth until they reach a level where they can contribute to taxes as part of the more affluent categories,” he said.

The committee’s recommendation entails exempting individuals earning less than ₦25 million annually from paying all forms of taxes, including income tax and value-added tax (VAT).

Oyedele highlighted the necessity of tax reform, noting its far-reaching impact on both businesses and the general population.

He called for the use of data to inform policy decisions and proposed a significant increase in the threshold for tax exemption to account for inflation and to support the informal sector’s growth.

Oyedele outlined the committee’s stance, advocating for legal exemption from all taxes for 95% of the informal sector, including withholding tax, company income tax, and payee on their staff.

”Moreover, our aim is to shift its focus to the top 5% of the informal sector, alongside the middle class and elites, for taxation purposes,” he added.

Oyedele stressed the importance of accountability and compliance with tax laws, urging leaders to lead by example and fulfil their tax obligations to lawful authorities promptly and accurately.

”The proposed tax revolution reflects a concerted effort to promote economic inclusivity, support small businesses, and ensure equitable taxation practices in Nigeria.

”By prioritizing the needs of the informal sector, it will foster sustainable economic growth and development across the country,” he noted.